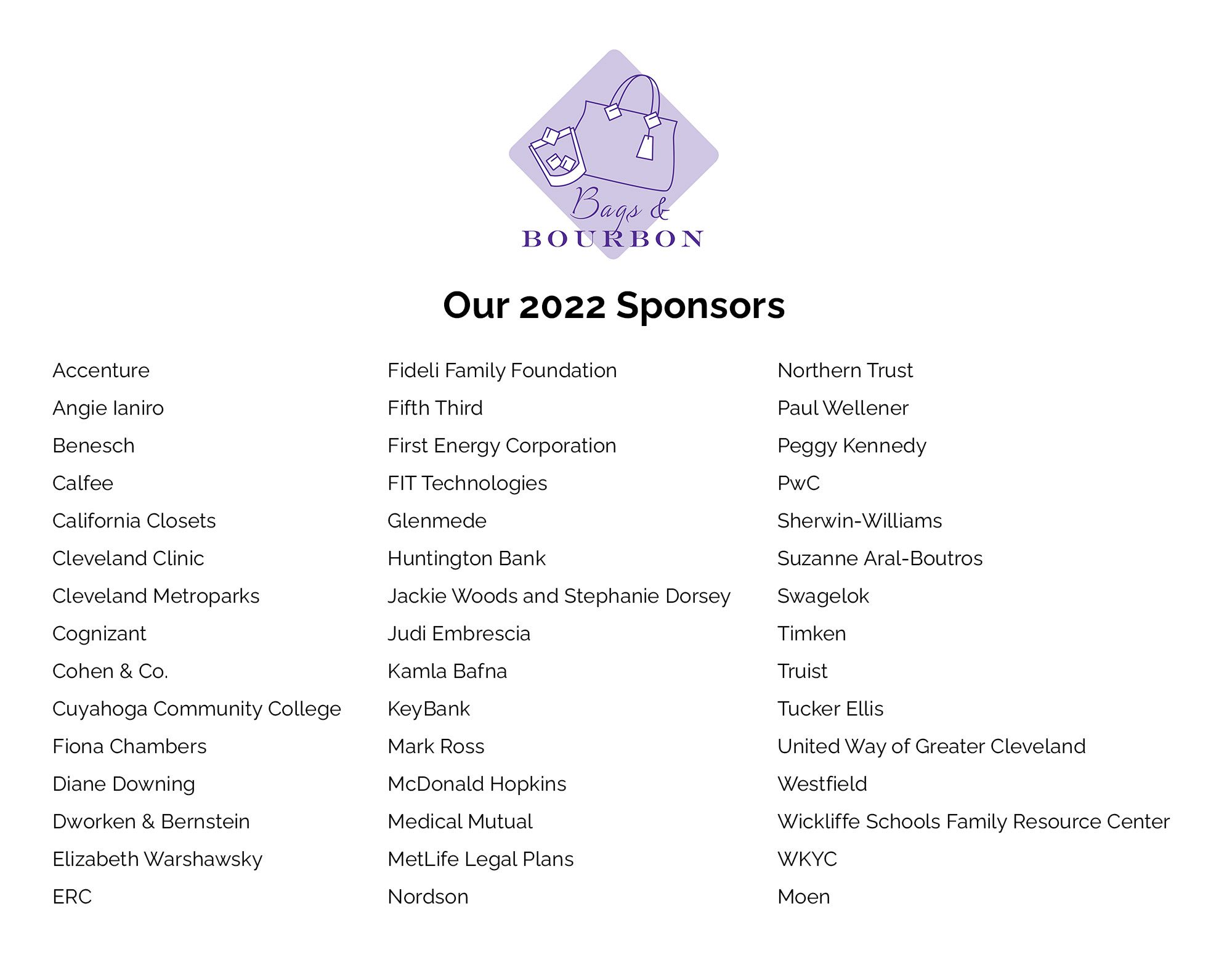

The next two blog posts veer away from state and federal policy issues that we have been addressing in recent articles and instead focuses on the students that these policies impact. The three interns referenced in this (names changed for privacy) come from different socioeconomic statuses, attended different high schools and are currently enrolled in three different colleges. Despite these differences, their stories have commonalities that unify their college-going experiences and their paths that brought them to College Now this summer.

College Now Interns on the Issues: Part 1

Each summer College Now is privileged to hire interns to help the organization with programing, development and operations. To be an intern at College Now, students must be in a degree-seeking program and have an interest in helping students obtain postsecondary credentials. The students who apply to intern at College Now are frequently attracted to the opportunity due to their own frustrations with the college-going process and a desire to help students navigate their paths to and through college. College Now interns are often former recipients of College Now services and current recipients of a College Now scholarship.

On the college selection process:

Three years ago, Brianna, now a rising junior, had her heart set on Xavier University in Cincinnati. However, upon seeing her award letter, she knew that making the in-state private school work for her family financially would be nearly impossible. Brianna was (understandably) averse to taking out federal student loans and, while she planned to apply for scholarships, she knew that depending on them to make ends meet would be equally “risky.” Instead, Brianna accepted enrollment at her second-choice institution, Mercyhurst College in Pennsylvania.

Steph’s first choice was Capital University in Columbus. Steph “wanted to get away from home and have that ‘college experience.’” At the advice of her counselor, she also applied to Baldwin Wallace “since it was like Capital but without the two-hour drive.” After weighing all her options, Steph decided to attend Baldwin Wallace and commute from home: “It would be $12,000 cheaper, and I was lucky enough to have been awarded scholarships to cover fees.”

For Rachel, college costs were a leading factor in her college decision. If cost were no issue at all, she “would probably have considered a lot more out-of-state options and would have seriously considered applying to programs I wanted within those schools.” While she did apply to two out-of-state schools, and was accepted to both, she knew she “could not seriously consider them as options unless granted a significant amount of scholarship money.” Rachel is currently a junior at Ohio State University.

On the financial aid process:

Steph has been chosen for verification every year she completed the FAFSA so “has had to send in additional paperwork, which is annoying.” Just this past year, she lost her Pell-eligibility, and will need to take out a loan or apply for more scholarships for her junior and senior year.

For Brianna, “the FAFSA was smooth sailing” for her freshman and sophomore year of college. She hit a bump in the road entering her junior year when she had to complete verification paperwork. “The process was not hard, just annoying. Completing the verification paperwork was re-submitting documents. I basically had to complete the FAFSA twice (and who wants to do that?!). But it was necessary in order to continue receiving the Ohio College Opportunity Grant and the Pell Grant along with two loans,” Brianna said.

On balancing academics, work, and life:

Now in college, Brianna “learned that being an adult is expensive . . . Trying to balance school and sleep is difficult enough – trying to find time to work to afford expenses on top of that is even harder.” Brianna is eligible for Federal Work Study and works on campus for a professor in her department. This has the added benefit of helping Brianna build a professionally relevant relationship and limits the number of hours she can work so she can focus on her academics.

Steph learned the importance of balance the hard way. “During my first year, I was working full-time while also attending school full-time, and it made a major impact on my grades because I was not dedicating my time to what really mattered,” Steph said. Eventually Steph “cut down to working 30 hours per week during the spring semester and had all As.” Steph learned that “ultimately, it all comes down to prioritizing and being able to take a step back from whatever is hurting your academic success. What I realized is that long-term outweighs the short-term. It’s great to be getting $600 paychecks while in school but it’s not so great when you’re receiving Cs and low-Bs when you know you could be getting As.”

This past year, Rachel worked a part time job while she was in school. Rachel found it “exhausting at times to come home from work and immediately have to start studying or writing a paper.” However, it was necessary as she “would not be able to afford to participate in extracurriculars otherwise.” Rachel “doesn’t think that working part time necessarily hurt my academic success, but it did force me to prioritize my time and miss out on some things I wish I could have done.”

In our next post, we share these women’s outlook for the future, their concerns about student loan repayment, and the federal and state policies they would change if given the opportunity.]]>